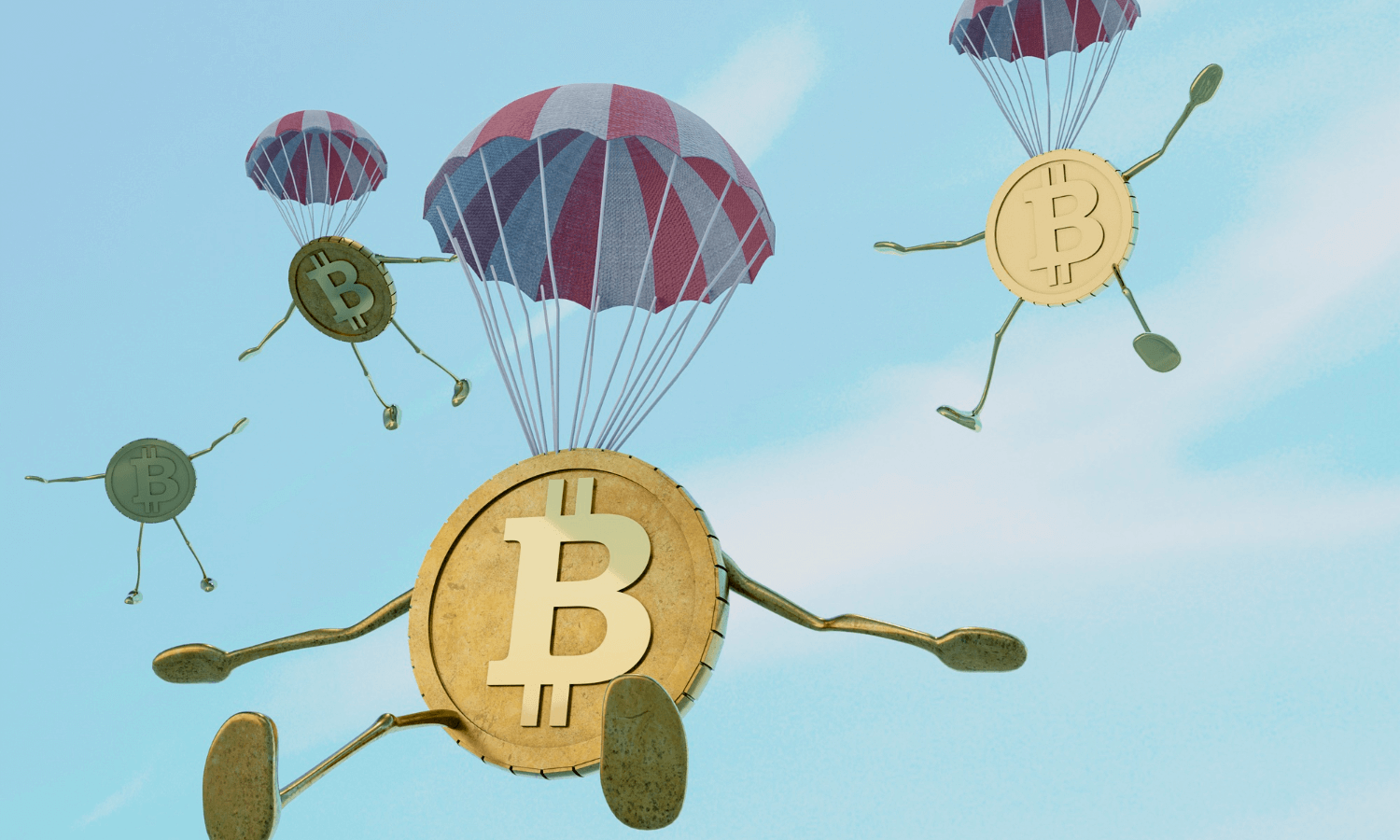

Has the bitcoin bubble burst?

Bitcoin’s price plummets—should you “buy the dip”? Plus, Canada’s first levered bitcoin and ethereum ETFs are here. The post Has the bitcoin bubble burst? appeared first on MoneySense.

Welcome to the Canadian Crypto Observer. Financial journalist and author Aditya Nain offers perspective on market-moving headlines to help Canadian investors navigate the cryptocurrency market.

Is crypto crashing?

The stock market is down—and so is bitcoin. Since December 2024, bitcoin (BTC) has fallen from over $106,000 to under $78,000 in recent days. (All figures in this article are in U.S. dollars.) That’s a 26% drop, most of which has happened in February and March. The decline is likely driven by fear and uncertainty stemming from a global trade war and the resulting possibility of inflation, a recession or both. What does this mean for Canadian investors? Let’s put this in perspective.

The best crypto platforms and apps

We’ve ranked the best crypto exchanges in Canada.

Crypto crash or just a correction?

A 26% price drop seems like a lot to investors accustomed to stock market movements, but it’s par for the course in crypto. While a 20% fall in a major stock index like the S&P 500 or the S&P/TSX Composite Index would be considered a bear market, 30% is merely a correction in crypto. BTC corrections shake out investors who can’t afford the volatility in their portfolio. In a full-blown crypto bear market—which has typically come around every three to four years—bitcoin has historically lost over 80% from peak to trough. (Read more about BTC’s bull and bear market cycles.)

Despite these bear market crashes of over 80%, BTC has risen over 8,400% over the past eight years, from Mar. 10, 2017, to Mar. 10, 2025. That’s a compounded annualized growth rate (CAGR) of over 74%. However, it would not be prudent to expect this high a return over the next eight to 10 years, because BTC is more mature as an asset class and, as a result, its risk-return profile has been reduced to some extent.

As the logarithmic chart below shows, BTC’s gains have tempered over the past five years, compared to what they used to be. All in all, while the recent drop in the BTC price is brutal for investors, it’s not out of the ordinary and, given BTC’s historical price movements, it’s to be expected.

Should you be greedy when others are fearful?

If you’re invested in crypto for the long term, you may be looking at the current price drop as a buying opportunity. In investing, it’s best to be greedy when others are fearful, and fearful when others are greedy, as Warren Buffett, CEO of Berkshire Hathaway, has said.

This means buying when prices are down and investors are panic-selling, and selling when prices and greed are high. There’s actually a fear and greed index that tracks the pulse of the crypto market. Right now, it’s screaming fear. That makes the current market a possible buying opportunity, for those willing to stomach the risk.

The graphic above shows the CMC Crypto Fear and Greed Index at 25, bordering on extreme fear (the red portion). Typically, periods of greed or extreme greed are good buying opportunities.

CMC Fear and Greed Index in the recent past

As the table below shows, this index has consistently indicated fear in the market during the past month.

Timeline Fear and Greed Index Index result At press time (Mar. 18, 2025) 25 Fear Previous week 15 Extreme fear Previous month 38 Fear

Jurrien Timmer, director of global macro at Fidelity Investments, says the bitcoin correction has brought the cryptocurrency’s valuation down to more palatable levels. For investors, this could be another reason to buy more for the long term. Timmer bases his view on a bitcoin valuation model. Here’s what he has to say:

With the momentum trade in reverse, Bitcoin has corrected back to about $85k. Judging by open interest and ETP flows, this seems to be mostly caused by tourists who jumped on the momentum train last November.

When the price action gets noisy and volatile, it’s always good to… pic.twitter.com/Iz2T9H1Pvw— Jurrien Timmer (@TimmerFidelity) March 4, 2025

Will the upcoming federal election affect crypto in Canada?

It seems likely that Canada will hold a federal election in April 2025. We know that a new president has been a game changer for crypto in the U.S. Will the same be true for Canada?

As things stand, it seems like Canada’s next prime minister will be either Conservative leader Pierre Poilievre or Liberal leader (and current PM) Mark Carney. Based on previous comments each has publicly made, it would seem Poilievre is more explicitly crypto-friendly than Carney. However, I doubt this matters much, and here’s why: The Canadian crypto ecosystem won’t be any different under one or the other of these two PM hopefuls. Fundamentally, Canada has been a crypto-friendly country for a number of years, and it already has in place core regulatory frameworks that are central to the growth of the crypto ecosystem. Here are some examples.

- The process to become a regulated crypto exchange in Canada is in place, and major exchanges are either already regulated or in the process of getting there.

- The Canada Revenue Agency (CRA) has in place rules and guidance for various crypto transactions and how they are taxed. (Read about crypto and taxes.)

- Canada was the first country to approve and launch a spot bitcoin ETF, over three years ago—long before the U.S.

- Canada already boasts several publicly listed crypto companies, such as WonderFi Technologies Inc. (WNDR), Hive Blockchain Technologies Ltd. (HIVE) and Galaxy Digital Holdings Ltd. (GLXY).

There are no indications that either Carney or Poilievre would make core changes to the existing crypto-friendly ecosystem. And there aren’t any indications that either would be hostile to bitcoin or crypto. We won’t see anything like the landscape change that’s happened in the U.S. since Trump was re-elected. Read more about how he’s changing the crypto landscape in the U.S.

MoneySense’s ETF Screener Tool

Canada’s first levered crypto ETFs have launched

Canadian investors can now buy and sell levered BTC and ether (ETH) exchange-traded funds (ETFs), offered by Evolve ETFs. A levered ETF uses financial instruments known as derivatives to amplify the return of the underlying asset—in this case, BTC or ETH. Caution: This investing strategy amplifies gains and losses.

The Evolve Levered Bitcoin ETF (LBIT) and the Evolve Levered Ether ETF (LETH) trade on the Toronto Stock Exchange and use up to 25% leverage. So, investors get exposure to 1.25 times the daily price movements of BTC and ETH. For example, if BTC itself gains 1% on a particular trading day, LBIT may gain 1.25%. On the other hand, if BTC drops 1% in a day, LBIT holders will see a drop of 1.25%.

Levered ETFs are generally used by experienced investors and traders who can deal with the added risk and volatility that comes with using leverage. For most regular crypto investors in Canada, though, spot ETFs are more suitable. (See a list of all spot BTC ETFs in Canada.)

Crypto price swings are common

Bitcoin, ethereum, XRP, solana and other crypto coins are speculative and subject to significant price swings—as the recent drop from over $109,000 to under $80,000 has demonstrated. Investing in crypto carries significant market, technological and regulatory risks. Invest in crypto only if it’s aligned with your investment goals, time horizon and risk profile, and stay vigilant about crypto scams.

More about crypto:

- Will bitcoin crash in 2025?

- Bitcoin tops USD$100,000 for the first time

- Price of bitcoin hits new high after Trump victory, and more crypto news

- How to protect your crypto from hacks

Get free MoneySense financial tips, news & advice in your inbox.

The post Has the bitcoin bubble burst? appeared first on MoneySense.