Millennium, Citadel, and Point72 alums are building the next wave of multistrategy funds

"When you sit in those circles, when you sit on those committees, you learn about how to run this kind of business," one hedge fund recruiter said.

Phil McCarten/Reuters; Citadel; Dave Kotinsky/Getty Images

- Former executives from Citadel, Millennium, and Point72 are in senior positions across the industry.

- The leading firms have become a pool of talent for smaller rivals to poach from.

- Managers such as Walleye, Capula, Fortress, Jain Global, and more have hired alums of the biggest funds.

As Dmitry Balyasny thought about the next stage of his eponymous firm's evolution and the leaders to shepherd it, he wanted someone who had been there before.

Balyasny hired Millennium's one-time chief financial officer, Kevin Byrne, as its chief operating officer last summer. This move brought on one of the few people who can say they know what it's like to work in the C-suite of a large multistrategy firm. Byrne had been among the leadership of Izzy Englander's firm when it was roughly the size of $23 billion Balyasny today.

For those in charge of smaller multistrategy funds, the place to find the talent to take you to the next level is obvious: the three biggest firms in the sector, Englander's Millennium, Ken Griffin's Citadel, and Steve Cohen's Point72.

The three firms, which manage more than $180 billion combined and employ more than 10,000 people, have become the recruiting grounds for firms in need of experienced executives in the same way that Julian Robertson's Tiger Management was once the launching pad for aspiring fund founders.

It's another example of the institutional qualities of the top tier of the $4.5 trillion industry. Decades ago — when a hedge fund would have felt crowded with more than 100 people on staff — banks, consulting firms, law firms, and accounting giants served as feeders for hedge funds looking to fill out their executive ranks.

No one could say they knew what it takes to run a multistrategy firm with tens of billions in capital because it had never been done. Now that's changed, and those involved with the day-to-day management of the biggest firms in the industry have become hot commodities for those hoping to break into the top tier.

"When you sit in those circles, when you sit on those committees, you learn about how to run this kind of business," said John Pierson, an industry recruiter who founded P2 Investments.

"They want that DNA, that top .0001% DNA, from the top shops," he said, referring to the biggest multistrategy firms.

The names

The firms tapping into this talent include upstart platforms like Walleye, new launches like Jain Global, and established managers hoping to carve out their own spot in the multistrategy sector like Capula. And for those who leave Millennium, Citadel, and Point72, it's often for jobs and titles that give them more responsibility and runway, Pierson said.

"It's all about control and creation," he said.

While many of these roles are filled by people who made their name in the industry because of their investing chops — and a select few do still trade a book — the real value from these individuals comes from their managerial or business-building abilities.

And titles can be deceiving. Chief investment officers and strategy heads at most platforms do not run a portfolio themselves, but instead manage, recruit, and train legions of investors beneath them.

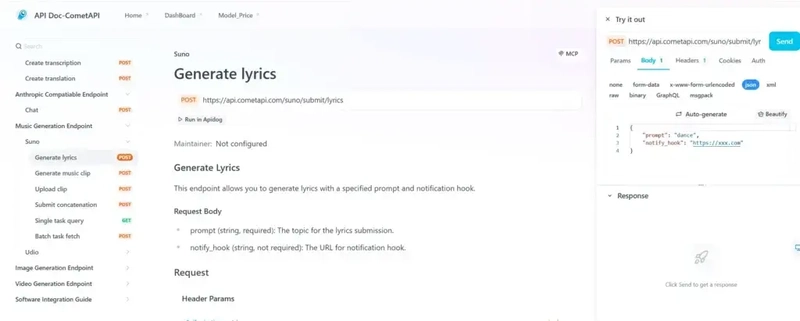

Below is a rundown of some names and roles that fit the bill. The story continues below the table. Those with an asterisk next to their name have worked at several different firms, often other multistrategy hedge funds, since leaving one of the three big platforms.

| Name | Role | Current Firm | Former Firm |

| John Anderson | CIO of Capula Multistrategy Fund | Capula | Millennium |

| Dev Joneja | Chairman of Risk | ExodusPoint | Millennium |

| Hyung Lee | Cofounder and Advisor | ExodusPoint | Millennium |

| Stephen Haratunian | Chief Risk Officer | Jain Global | Millennium |

| Di Wu | Head of Execution Services | Schonfeld | Millennium |

| David Pereira | Chief Risk Officer | Verition | Millennium |

| Meghan Tudor | Head of Talent Management | Schonfeld | Millennium |

| Jeff Runnfeldt* | CIO of Fortress Multi-Manager Group | Fortress | Citadel |

| Colin Lancaster* | Head of EMEA and Cohead of Discretionary Macro and Fixed Income | Schonfeld | Citadel |

| Michael Moreau* | Deputy COO of Fundamental Equity | Schonfeld | Citadel |

| Noah Goldberg | Chief Compliance Officer | Jain Global | Citadel |

| Townie Wells | CIO of Fundamental Equities | Jain Global | Citadel |

| Joe Macaione | Head of North America Client Relations Group | LMR | Citadel |

| Seth Kammerman | Global Head of Funding and Liquidity | Verition | Citadel |

| Matt Giannini* | COO of Fundamental Equity Long-Short | Walleye | Citadel |

| Maureen Reed | Chief People Officer | Walleye | Citadel |

| Tom DeAngelis | President and Partner | Walleye | Citadel |

| Dan Schatz | Global Head of Credit | Marshall Wace | Citadel |

| Matt Dolente | Managing Director, Cohead of Global Long-Short Equity | Davidson Kempner | Point72 |

| Mike Daylamani* | Founding Principal and Head of Synthesis | Engineers Gate | Point72 |

| Rachel D'Antonio | Deputy COO | Jain Global | Point72 |

These three managers have also been the place where many founders of new multistrategy firms — which require more boardroom tact than market savviness from their leaders — have been groomed. Millennium spawned the industry's two biggest platform launches: Michael Gelband's ExodusPoint and Bobby Jain's Jain Global.

Englander's former executives have also started two of Asia's biggest multistrategy launches: Jonathan Xiong's Singapore-based Arrowpoint Investment Partners and Kurt Baker's Hong Kong-based 30th Century Partners.

Equity-focused multimanager funds from Citadel alumni have vaccumed up billions in capital. Managers include Holocene Advisors, founded by Brandon Haley; Candlestick Capital, founded by Jack Woodruff; Woodline Partners, cofounded by Michael Rockefeller and Karl Kroeker; Cinctive Capital, cofounded by Richard Schimel and Larry Sapanski; and, most recently, Freestone Grove Partners, founded by Todd Barker. Additionally, Dymon Asia cofounder Danny Yong was once Citadel's top Asia executive before starting his own firm.

Two former executives from Cohen's umbrella, Doug Haynes and Tom Conheeney, have each tried to launch their own multi-strategies offering, but both were ultimately unable to get them off the ground. Still, Point72 executive Angus Wai launched Asia-based Polymer Capital in 2019.

Balyasny as a case study

There's a road map for founders tapping talent from Citadel, Millennium, and Point72 in the hopes of spurring their next wave of growth: Balyasny.

While it hasn't always been smooth, the Chicago-based fund has expanded significantly in recent years. At the end of a tough 2018 that resulted in dozens of layoffs, the manager had $6 billion in assets. It now runs $23 billion and has expanded into asset classes like commodities and geographies like Denmark and Dubai. Lucy Nicholson/Reuters

While Balyasny and his cofounders Taylor O'Malley and Scott Schroeder still lead the firm, with Balyasny himself recently taking on more control over the fund's stockpickers, the firm's executive ranks are littered with alums of its three larger rivals, including the aforementioned Byrne. In fact, the firm's past poaching of Citadel talent — which also included Runnfeldt and Giannini — sparked a mini turf war between Griffin and Balyasny years ago.

Current Balyasny executives from Citadel, Millennium, and Point72 include:

- Alex Lurye, former chief risk officer for Citadel, who now sits in the same seat at Balyasny

- Steve Goldberg, one-time senior portfolio manager at Citadel, who coheads the fixed-income and macro investing teams at Balyasny

- Francine Fang, once the deputy head of investments for Cohen's quant unit Cubist, who currently is Balyasny's global head of systematic

- Bill Wappler, a former Point72 research executive, who is a partner and director of research at Balyasny

- Gappy Paleologo, an alum of Millennium and Citadel, who is Balyasny's new global head of quantitative research

- Peter Goodwin, a one-time star PM for Point72, who is running his own unit, Longaeva Partners, within Balyasny

- Thomas Stephens, a former PM for Millennium and Citadel, who is the senior managing director of stock-picking unit Corbets Capital

- Steve Schurr, a Point72 portfolio manager before joining Balyasny, who is a senior managing director of fundamental equities

- Joe Lanzillotti, a one-time controller at Millennium, who is Balyasny's deputy CFO

- Anita Nassar, once a partner at Citadel, who is the global head of the client relations group for Balyasny

- Joe Snodgrass, the former spokesperson for Millennium, who is the chief communications officer at Balyasny

As Citadel and Point72 return capital and Englander considers selling a stake in Millennium, Balyasny has positioned itself as not just a rival to the three biggest firms, but a legitimate peer.

One point of proof is that smaller multi-strategy funds, as well as the biggest in the industry, are hiring Balyasny alums to be leaders.

Walleye, for instance, named former Balyasny PM Anil Gondi the firm's head of long-short equity last year, and Daylamani and Runnfeldt worked in leadership roles at Balyasny before joining Engineers Gate and Fortress, respectively. Schonfeld's co-heads of its macro and fixed-income investing unit, Colin Lancaster and Mitesh Parikh, both traded for Balyasny before starting their own firm and eventually joining Schonfeld.

Jared Hade, meanwhile, will start as Point72's chief financial officer in the second half of the year after spending close to 20 years at Balyasny.

"The big three," as one industry recruiter put it, "is now the big four."