11 credit cards that offer Priority Pass airport lounge access

Editor’s note: This is a recurring post, regularly updated with new information and offers. Accessing an airport lounge can make traveling much more enjoyable by providing a quiet space to work, free Wi-Fi, complimentary food and drinks and sometimes even top-tier amenities like showers, kids’ areas and quiet rooms. While access to airport lounges typically …

Editor’s note: This is a recurring post, regularly updated with new information and offers.

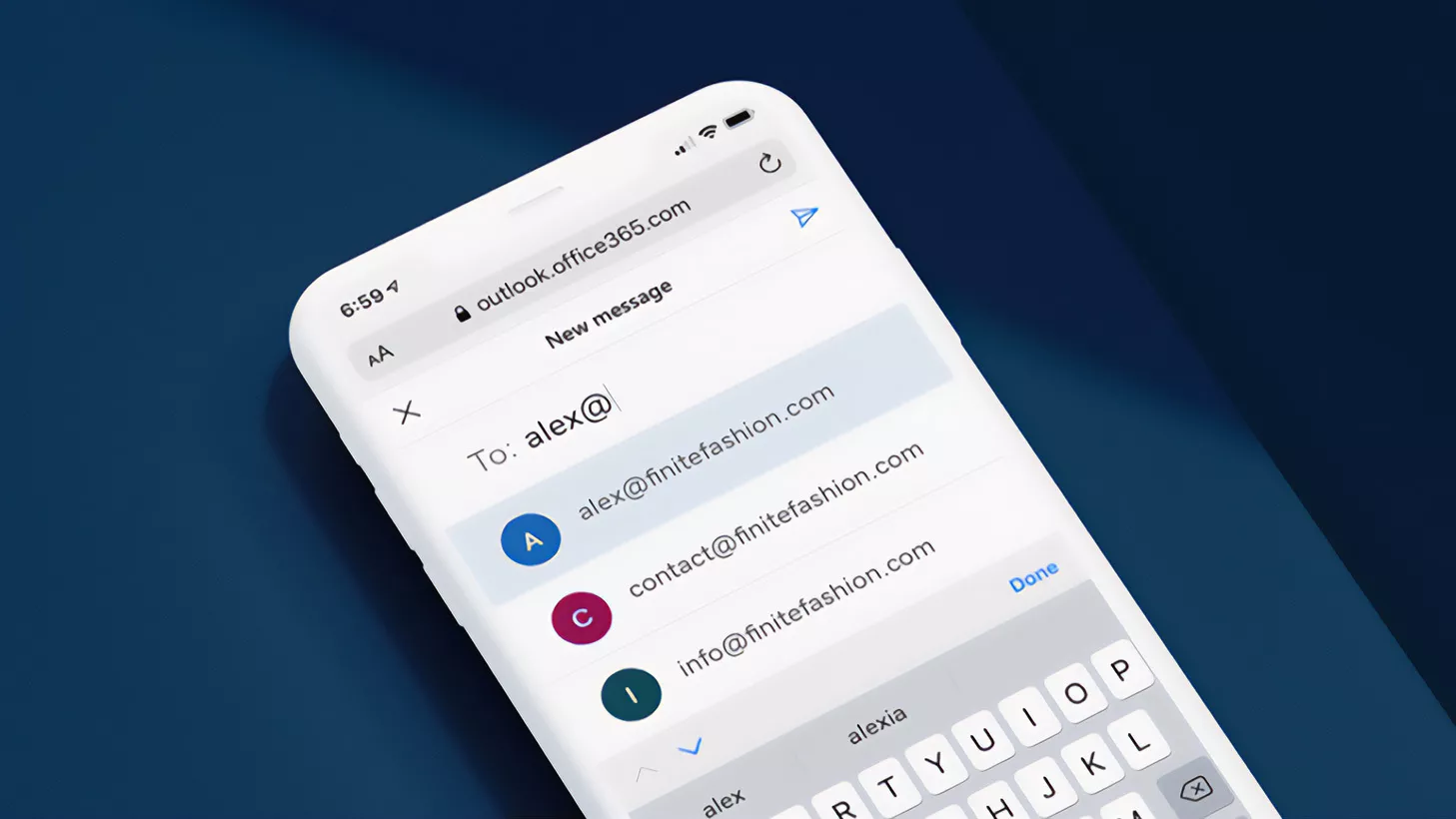

Accessing an airport lounge can make traveling much more enjoyable by providing a quiet space to work, free Wi-Fi, complimentary food and drinks and sometimes even top-tier amenities like showers, kids’ areas and quiet rooms.

While access to airport lounges typically requires payment, several of the best travel rewards credit cards include airport lounge access among their many benefits.

Some airline credit cards, such as the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) and the United Club℠ Card (see rates and fees), only get you into their own carriers’ lounges.

Others, however, including The Platinum Card® from American Express, the Chase Sapphire Reserve® (see rates and fees) and the Capital One Venture X Rewards Credit Card, allow cardholders to register for Priority Pass Select memberships and enjoy access to over 1,700 airport lounges worldwide (enrollment is required for the Amex Platinum; terms apply).

With all that in mind, here are the best credit cards for Priority Pass lounge access at airports worldwide and how to use them to improve your upcoming travels.

Related: Everything you need to know about the Priority Pass airport lounge program

Which are the best credit cards for Priority Pass lounge access?

The following cards offer Priority Pass lounge access, though the number of visits included and guest policies can vary widely:

- Capital One Venture X Rewards Credit Card

- Capital One Venture X Business

- Chase Sapphire Reserve

- Citi Prestige® Card

- The Platinum Card from American Express

- The Business Platinum Card® from American Express

- Marriott Bonvoy Brilliant® American Express® Card

- U.S. Bank Altitude™ Reserve Visa Infinite® Card

- U.S. Bank Altitude® Connect Visa Signature® Card

- Bank of America® Premium Rewards® Elite credit card

- JetBlue Premier Card

The information for Citi Prestige, U.S. Bank Altitude Reserve Visa Signature, U.S. Bank Altitude Connect Visa, Bank of America Premium Rewards Elite and JetBlue Premier cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Enrollment is required for select benefits for American Express cards. Terms apply.

Related: The 10 best Priority Pass lounges around the world

Comparing cards with Priority Pass access

Here are the details on each card, along with current welcome bonuses, annual fees and other notable perks:

| Card | Lounge access | Welcome bonus | Annual fee |

| Capital One Venture X | Cardholder plus two guests; authorized users also get the same benefit | Earn 75,000 bonus miles after spending $4,000 on purchases in the first three months from account opening. | $395 |

| Capital One Venture X Business | Cardholder plus two guests, | Earn 150,000 bonus miles after spending $30,000 in the first three months from account opening. | $395 |

| Chase Sapphire Reserve | Cardholder plus two guests, $27 per guest after that | Earn 60,000 bonus points after spending $5,000 on purchases in the first three months from account opening. | $550 |

| The Platinum Card from American Express | Cardmember plus two guests, $35 per guest after that. Enrollment is required; terms apply. | Earn 80,000 points after spending $8,000 on purchases within the first six months of cardmembership (possibly higher targeted offers through CardMatch, subject to change at any time and not everyone will be targeted for the same offers). | $695 (see rates and fees) |

| The Business Platinum Card from American Express | Cardmember plus two guests, $35 per guest after that. Enrollment is required; terms apply. | Earn 150,000 points after spending $20,000 on eligible purchases within the first three months of cardmembership. | $695 (see rates and fees) |

| Citi Prestige | Cardholder plus immediate family or two guests, $27 per guest after that. | Not available to new applicants. | $495 |

| Marriott Bonvoy Brilliant | Cardmember plus two guests, $35 per guest after that. Enrollment is required; terms apply. | Earn 185,000 bonus points after spending $6,000 within the first six months of cardmembership. Offer ends May 14. | $650 (see rates and fees) |

| U.S. Bank Altitude Reserve Visa Infinite | 8 complimentary visits per 12-month Priority Pass membership year for cardholder or guests, $35 per visit after that. | Not available to new applicants. | $400 |

| U.S. Bank Altitude Connect Visa Signature | 4 complimentary visits per 12-month Priority Pass membership year for cardholder or guests, $35 per visit after that. | Earn 20,000 bonus points after spending $1,000 within 90 days of account opening. | No annual fee |

| Bank of America Premium Rewards Elite credit card | Cardholder plus two guests; up to four Priority Pass memberships; $35 for each additional guest | Earn 75,000 bonus points after spending $5,000 within 90 days of account opening. | $550 |

| JetBlue Premier | Cardholder plus one guest; $35 for each additional guest | Earn 70,000 bonus points and 5 Mosaic tiles after spending $5,000 in the first 90 days of account opening. | $499 |

Cards with Priority Pass memberships

Now that we’ve reviewed each card’s Priority Pass-specific perks, here are some of the other compelling benefits each offers.

Capital One Venture X

Capital One’s premium travel credit card packs a punch. First, it offers $300 in annual credits toward bookings made through Capital One Travel. Then, you also get 10,000 bonus miles every account anniversary (worth even more toward free travel). Both of these perks help offset the card’s $395 annual fee.

Add in extensive airport lounge access (including Capital One’s own lounges and Priority Pass Select), plus excellent travel protections and rental car insurance, and we’re talking about one of the best premium cards out there.

It is worth noting, however, that Priority Pass membership from Capital One cards does not include Priority Pass restaurants and spa services.

To learn more, check out our full review of the Capital One Venture X.

Learn more: Capital One Venture X

Capital One Venture X Business

The Venture X Business card offers many of the same benefits as the Venture X card, including $300 in annual credits for bookings made with Capital One Travel, 10,000 anniversary bonus miles and access to Capital One lounges.

You’ll also receive unlimited visits to Priority Pass lounges.

To learn more, check out our full review of the Venture X Business.

Learn more: Capital One Venture X Business

Chase Sapphire Reserve

The Chase Sapphire Reserve is one of the most popular premium travel rewards credit cards, thanks to its impressive list of benefits. Notably, cardholders receive up to $300 in annual statement credits for a wide range of travel purchases.

The card earns bonus Ultimate Rewards points on popular spending categories like travel* and dining.

Ultimate Rewards can be transferred to 11 airline partners and three hotel partners. Points may also be redeemed at 1.5 cents apiece through Chase Travel℠.

This card reimburses members up to $120 once every four years for a Global Entry, Nexus or TSA PreCheck application and lacks foreign transaction fees.

To learn more, check out our full review of the Sapphire Reserve.

*Bonus rewards on travel are earned after the first $300 is spent on travel annually.

Apply here: Chase Sapphire Reserve

The Platinum Card from American Express

In addition to Priority Pass lounges, cardmembers can access Amex’s Centurion Lounges, Delta Sky Clubs*, Escape Lounges and certain Lufthansa lounges, among others. Enrollment is required for select benefits. Terms apply.

The card earns 5 points per dollar on airfare booked directly with the airline or with American Express Travel (on up to $500,000 on these purchases per calendar year, then 1 point per dollar) and 5 points per dollar prepaid hotels booked with Amex Travel. Cardmembers can transfer Membership Rewards points to 21 airline and hotel partners.

The card also comes with a laundry list of perks, including an annual up to $200 statement credit on incidental fees charged by an airline you select each calendar year and up to $200 in Uber Cash each calendar year (up to $15 each month, plus a bonus up to $20 in Dec.) toward U.S. Uber rides and U.S. Uber Eats orders**, among other credits that provide a lot of potential value each year. Enrollment is required.

To learn more, check out our full review of the Amex Platinum.

*Eligible Platinum Card Members will receive 10 Visits per Eligible Platinum Card per year to the Delta Sky Club or to Grab and Go when traveling on a same-day Delta-operated flight.

**Uber Cash will only be deposited into one Uber account when you add the Amex Platinum as a payment method and redeem with any Amex card.

Apply here: The Platinum Card from American Express

The Business Platinum Card from American Express

The Amex Business Platinum offers a host of annual statement credits, including up to $400 in statement credits each calendar year (up to $200 semi-annually) for U.S. Dell purchases (through June 30), an up-to-$120 credit for U.S. wireless service providers each calendar year (up to $10 per month) and much more. Enrollment required for select benefits. Terms apply.

Cardmembers earn 1.5 points per dollar on up to $2 million in eligible purchases in the U.S. per calendar year (then 1 point per dollar) in common business categories, including U.S. electronic goods retailers, U.S. shipping providers and on purchases of $5,000 or more.

They also receive a 35% bonus when redeeming points through Amex Pay with Points for economy airfare on their designated airline (enrollment is required, terms apply) or for business- or first-class tickets on select qualifying airlines, up to 1 million points back per calendar year. Terms apply.

The Amex Business Platinum offers the same lounge benefits as the consumer Amex Platinum above, including the same limitation on not receiving access to Priority Pass restaurants.

To learn more, check out our full review of the Amex Business Platinum.

Apply here: The Business Platinum Card from American Express

Citi Prestige

Unfortunately, the Citi Prestige is no longer available to new applicants.

If you’re a current cardholder, however, you can enjoy Priority Pass lounge access as one of your card’s benefits. Unlike many other premium cards, the Citi Prestige offers Priority Pass restaurant access.

To learn more, check out our full review of the Citi Prestige.

Marriott Bonvoy Brilliant American Express Card

This card is a great way for Marriott Bonvoy loyalists to earn bonus points on Marriott bookings. The Bonvoy Brilliant earns 6 points per dollar on Marriott purchases, in addition to the bonus points you’ll earn from the card’s complimentary Platinum Elite status.

Cardmembers get up to $300 in statement credits each calendar year for purchases at restaurants worldwide (up to $25 each month). For each cardmember anniversary after renewal, cardmembers receive a free night award worth up to 85,000 points at hotels participating in the Marriott Bonvoy program (certain hotels may have resort fees).

This card offers a number of other benefits aside from these, with its perks tailored to those who stay with Marriott at least a few times each year.

To learn more, check out our full review of the Bonvoy Brilliant.

Apply here: Marriott Bonvoy Brilliant American Express

U.S. Bank Altitude Reserve Visa Infinite Card

This card earns 5 points per dollar on prepaid hotels and car rentals booked directly in the Altitude Rewards Center, 3 points per dollar on travel and mobile wallet purchases and 1 point per dollar on everything else.

Cardholders can redeem points for 1.5 cents apiece on airfare, hotels and car rentals, but U.S. Bank does not offer transfer partners. They can also count on reimbursement for a Global Entry or TSA PreCheck application once every four years (up to $120).

Finally, this card comes with up to $325 in statement credits every year for eligible travel and dining purchases. While this card isn’t currently accepting applicants, existing cardholders can continue to enjoy its perks.

To learn more, check out our full review of the Altitude Reserve.

U.S. Bank Altitude Connect Visa Signature Card

It’s rare to see a card with no annual fee offering lounge perks, but note that you’ll only get four complimentary Priority Pass visits per year. Each visit after that costs $35.

This card earns bonus points on a wide range of categories, including gas, electric vehicle charging stations, dining, streaming services and groceries.

Cardholders also enjoy reimbursement for up to $100 of your Global Entry or TSA PreCheck application fee every four years. Even though this won’t cover the full cost of Global Entry, it will pay for most of it. That’s a huge perk for a card with no annual fee.

To learn more, check out our full review of the Altitude Connect.

Bank of America Premium Rewards Elite Credit Card

With Bank of America’s Premium Rewards Elite card, you’ll earn 2 points per dollar spent on travel and dining and 1.5 points per dollar on other purchases. However, you can earn up to 75% more on each purchase as a member of Bank of America’s Preferred Rewards® program.

Cardholders can take advantage of a Priority Pass Select membership to access over 1,700 lounges while also being able to bring in two guests at no cost. A unique perk of this benefit is that Bank of America allows up to four people to enroll and receive a Priority Pass Select membership.

Additional benefits for the cardmember include up to $300 in airline incidental fee credits per year, up to $150 in annual lifestyle credits for things like streaming services and food delivery and reimbursement for your Global Entry or TSA PreCheck application fee every four years. You’ll also receive a 20% discount when paying for flights with points using this card.

To learn more, check out our full review of the Premium Rewards Elite.

JetBlue Premier Card

The JetBlue Premier is the latest cobranded card offered by JetBlue. The card offers a Priority Pass membership in addition to access to JetBlue’s future lounges.

It stands out from most of its competitors by including Priority Pass restaurant access as well, per a Barclays representative. With so many cards dropping restaurant access, it’s refreshing to see a card keep this benefit.

The card comes with a $499 annual fee and other benefits for frequent JetBlue flyers, such as a free checked bag, priority boarding and 5,000 bonus points every card anniversary.

While this card may be tempting, we generally recommend the more affordable JetBlue Plus over this card. If you’re a JetBlue loyalist lacking Priority Pass access, however, it’s worth considering this card.

To learn more, check out our full review of the JetBlue Premier.

Bottom line

Accessing an airport lounge before your flight can be a great perk. Rather than paying for each visit, you can use popular travel credit cards to unlock access ahead of your trips regularly — and in many cases, this includes guest privileges, too.

Priority Pass is a great option for frequent travelers, thanks to its vast worldwide network of airport lounges and restaurants. Carrying a credit card that enables you to enroll in a Priority Pass Select membership can be a great way to save money and make your travel experience that much better.

If that sounds like you, consider adding one of the cards above to your wallet.

For rates and fees of the Amex Platinum card, click here.

For rates and fees of the Amex Business Platinum card, click here.

For rates and fees of the Marriott Bonvoy Brilliant card, click here.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.