Tokenization of Assets: Bridging the Physical and Digital Worlds

Abstract Tokenization is transforming the financial ecosystem by converting tangible and intangible rights into digital tokens on a blockchain. This post explores the background, core concepts, and applications of asset tokenization. We discuss its impact on liquidity, transparency, and democratized investment, while comparing its integration with open-source funding models. In addition, we cover challenges like regulatory hurdles and cybersecurity issues, and forecast future advancements in the digital economy. Links and examples from authoritative sources further illuminate this emerging technology. Introduction In today’s digital age, tokenization of assets has emerged as a revolutionary concept that bridges the gap between physical assets and their digital representations. By converting certificates of ownership or rights into digital tokens, this technology is reshaping financial systems and many traditional markets. Whether it’s real estate, fine art, commodities, or intellectual property, tokenization enables fractional ownership and 24/7 global trading on blockchain networks. This post will offer you an in-depth look into tokenization, its benefits, challenges, and future potential. With insights from blockchain technology and open-source projects, we explore how tokenization is democratizing investment and increasing market efficiency. Background and Context Tokenization is not only a modern financial tool but also an evolution of digital transformation in the asset space. Here are some key historical and contextual points: Blockchain Integration: Blockchain technology underpins tokenization by providing a secure, immutable, and decentralized ledger. For those who want to understand the fundamentals, check out what is blockchain. Evolution of Investment Models: Traditionally, investing in high-value assets, such as real estate or fine art, demanded high capital. Tokenization breaks these barriers by enabling fractional ownership, similar to crowdsourced funding as seen in crowdsourced funding for open source software. Open Source Synergies: Many innovative funding models in open source communities have paralleled the tokenization trend. The technological innovations that empower transparent funding models in open source ecosystems are analogous to those in tokenized asset markets. Defining Tokenization Tokenization refers to the process of converting rights to an asset into a digital token that is recorded on a blockchain. These tokens can represent: Utility tokens: Often granting access to services within an ecosystem. Security tokens: Regulated digital securities that convey investor rights. Non-Fungible Tokens (NFTs): Unique representations of ownership for art, collectibles, or property. For more insight into NFTs, see what are NFTs. The process is akin to issuing digital shares in an asset, making investment more accessible and cost-effective. Core Concepts and Features Blockchain’s Role A core element of tokenization is the blockchain. Using decentralized ledger technology, blockchain: Ensures Security: Each transaction is cryptographically secured. Maintains Transparency: All participants can verify transactions, reducing the risk of fraud. Reduces Intermediaries: Smart contracts automate contract enforcement, making transactions efficient. For more on how smart contracts operate, visit smart contracts on blockchain. Primary Features of Tokenization Below is a bullet list detailing the benefits of tokenization: Increased Liquidity: Traditional assets may be illiquid, but tokenization enables trading 24/7 on global markets. Cost-Effectiveness: Reduced intermediary fees and streamlined processes lower transaction costs. Inclusivity: Fractional ownership allows smaller investors to participate in high-value asset classes. Transparency and Immutability: The blockchain ledger provides traceable, verifiable records, similar to the transparency needed in open source funding models, as discussed in open source project financial transparency. Token Types and Their Use Cases Consider the following table that differentiates major token types in the tokenization space: Token Type Description Primary Use Cases Utility Tokens Provide access to network functions and services Subscription models, product discounts, ecosystem rewards Security Tokens Represent traditional securities with compliance and investor rights Debt, equity investments, fractional property ownership Non-Fungible Tokens (NFTs) Represent unique assets with distinct properties and provenance Digital art, collectibles, intellectual property rights Each token type plays a specific role in bridging the physical and digital worlds. Applications and Use Cases 1. Real Estate Tokenizing real estate allows for fractional ownership of properties. This means that instead of buying an entir

Abstract

Tokenization is transforming the financial ecosystem by converting tangible and intangible rights into digital tokens on a blockchain. This post explores the background, core concepts, and applications of asset tokenization. We discuss its impact on liquidity, transparency, and democratized investment, while comparing its integration with open-source funding models. In addition, we cover challenges like regulatory hurdles and cybersecurity issues, and forecast future advancements in the digital economy. Links and examples from authoritative sources further illuminate this emerging technology.

Introduction

In today’s digital age, tokenization of assets has emerged as a revolutionary concept that bridges the gap between physical assets and their digital representations. By converting certificates of ownership or rights into digital tokens, this technology is reshaping financial systems and many traditional markets. Whether it’s real estate, fine art, commodities, or intellectual property, tokenization enables fractional ownership and 24/7 global trading on blockchain networks. This post will offer you an in-depth look into tokenization, its benefits, challenges, and future potential. With insights from blockchain technology and open-source projects, we explore how tokenization is democratizing investment and increasing market efficiency.

Background and Context

Tokenization is not only a modern financial tool but also an evolution of digital transformation in the asset space. Here are some key historical and contextual points:

- Blockchain Integration: Blockchain technology underpins tokenization by providing a secure, immutable, and decentralized ledger. For those who want to understand the fundamentals, check out what is blockchain.

- Evolution of Investment Models: Traditionally, investing in high-value assets, such as real estate or fine art, demanded high capital. Tokenization breaks these barriers by enabling fractional ownership, similar to crowdsourced funding as seen in crowdsourced funding for open source software.

- Open Source Synergies: Many innovative funding models in open source communities have paralleled the tokenization trend. The technological innovations that empower transparent funding models in open source ecosystems are analogous to those in tokenized asset markets.

Defining Tokenization

Tokenization refers to the process of converting rights to an asset into a digital token that is recorded on a blockchain. These tokens can represent:

- Utility tokens: Often granting access to services within an ecosystem.

- Security tokens: Regulated digital securities that convey investor rights.

- Non-Fungible Tokens (NFTs): Unique representations of ownership for art, collectibles, or property. For more insight into NFTs, see what are NFTs.

The process is akin to issuing digital shares in an asset, making investment more accessible and cost-effective.

Core Concepts and Features

Blockchain’s Role

A core element of tokenization is the blockchain. Using decentralized ledger technology, blockchain:

- Ensures Security: Each transaction is cryptographically secured.

- Maintains Transparency: All participants can verify transactions, reducing the risk of fraud.

- Reduces Intermediaries: Smart contracts automate contract enforcement, making transactions efficient. For more on how smart contracts operate, visit smart contracts on blockchain.

Primary Features of Tokenization

Below is a bullet list detailing the benefits of tokenization:

- Increased Liquidity: Traditional assets may be illiquid, but tokenization enables trading 24/7 on global markets.

- Cost-Effectiveness: Reduced intermediary fees and streamlined processes lower transaction costs.

- Inclusivity: Fractional ownership allows smaller investors to participate in high-value asset classes.

- Transparency and Immutability: The blockchain ledger provides traceable, verifiable records, similar to the transparency needed in open source funding models, as discussed in open source project financial transparency.

Token Types and Their Use Cases

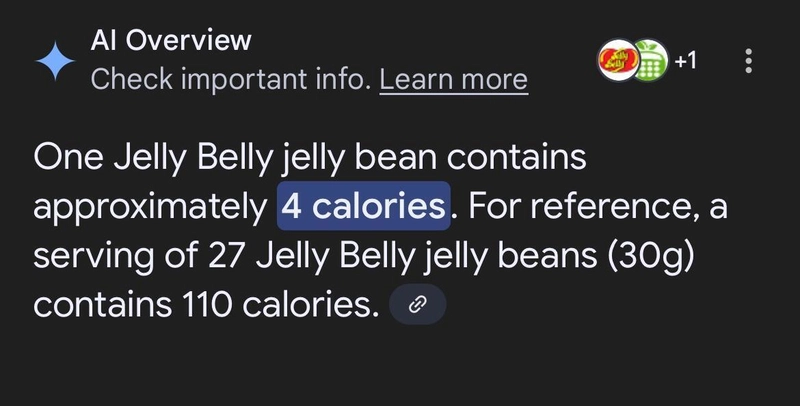

Consider the following table that differentiates major token types in the tokenization space:

| Token Type | Description | Primary Use Cases |

|---|---|---|

| Utility Tokens | Provide access to network functions and services | Subscription models, product discounts, ecosystem rewards |

| Security Tokens | Represent traditional securities with compliance and investor rights | Debt, equity investments, fractional property ownership |

| Non-Fungible Tokens (NFTs) | Represent unique assets with distinct properties and provenance | Digital art, collectibles, intellectual property rights |

Each token type plays a specific role in bridging the physical and digital worlds.

Applications and Use Cases

1. Real Estate

Tokenizing real estate allows for fractional ownership of properties. This means that instead of buying an entire property, investors can hold a digital share. This method expands liquidity and diversifies financing options. Developers can fund projects by issuing tokenized shares, offering an alternative to traditional financing methods—a concept somewhat similar to the ideas in open source project investment opportunities.

2. Fine Art and Collectibles

For the art market, tokenization is a game-changer. Digital tokens enable art collectors to invest in high-value pieces by owning fractions of artworks. Blockchain ensures authenticity and provenance, combating forgery issues. For further reading, visit nft art authentication. By leveraging blockchain, the art world can maintain a transparent and secure record of ownership.

3. Commodities and Precious Metals

Tokenized representations of commodities such as gold, silver, or oil can lower storage costs and facilitate faster transactions. Investors benefit by easily diversifying their portfolios and accessing global markets. Digital tokens can represent physical ownership while simplifying trading logistics.

4. Intellectual Property Rights

Artists and creators can monetize intellectual property by tokenizing rights to their creations. This allows the sale or sharing of royalties in a compliant and transparent manner.

Challenges and Limitations

While the potential of tokenization is vast, several challenges persist:

- Regulatory Uncertainty: Evolving guidelines across jurisdictions require investors and issuers to navigate complex legal landscapes. The regulatory environment for security tokens is still in flux, meaning compliance is a significant challenge.

- Cybersecurity Risks: Digital systems are inherently prone to hacking and cyber threats. Ensuring robust security measures across blockchain platforms is critical.

- Market Adoption: The technology requires widespread adoption and trust. Educating traditional investors on the benefits and security of tokenized assets is crucial.

- Standardization: The absence of universal standards for tokenization can hinder market efficiency. Efforts toward industry-wide best practices are necessary to provide consistency and reliability. Similar standardization issues are discussed in open source development funding.

Future Outlook and Innovations

The future of tokenization looks promising as further integration with existing financial systems continues. Here are key future trends expected to shape the field:

Hybrid Financial Models

The blending of traditional and digital asset management is on the horizon. As tokenization gains regulatory acceptance, financial institutions may adopt hybrid models. This would merge conventional practices with blockchain efficiencies, increasing market reach and investor participation.

Technological Advancements

Developments in smart contract technology, improved interoperability between different blockchains, and ongoing innovation in underlying network scalability are expected. These advancements will enable faster, more secure transactions and foster broad adoption.

Enhanced Regulatory Frameworks

Governments and regulatory bodies are gradually defining clearer guidelines for digital assets and security tokens. Enhanced frameworks will bolster investor confidence and promote global markets. Some institutions are already drawing inspiration from initiatives in blockchain adoption found in what is asset tokenization and FinTech Magazine.

Open Source and Community Funding Integration

In parallel with traditional tokenization, open-source methods for funding innovative projects will gain grip. Successful examples from the open source community, which combine decentralized funding with community governance—similar in spirit to innovative funding for open source projects—will encourage further experimentation and adoption.

Developer and Community Perspectives

Tokenization as a technology is not only transforming finance; it is also influencing the open-source ecosystem, providing novel means for funding and community governance. Some insights from the developer community include:

- Funding Open Source Contributors: Innovations like tokenized royalties are helping to create revenue streams for developers. For additional perspectives on funding models, see funding open source contributors.

- Sponsorship Models: Projects now often rely on decentralized sponsorships that leverage tokenized contributions, as discussed in sponsor open source projects on GitHub.

- Challenges in Monetization: Despite the surge in innovation, developers face hurdles in monetizing their work. Articles such as navigating the challenges of open source monetization provide further analysis.

These perspectives highlight how the same principles driving tokenization in finance are being integrated within the developer and open-source space, fostering a broader ecosystem of digital economy innovation.

Key Benefits Recap

To summarize, the benefits of asset tokenization include:

- Fractional Ownership: Allowing diverse investor participation by reducing the capital barrier.

- 24/7 Trading: Enabling global access and continuous market operation.

- Transparency and Security: Leveraging blockchain’s immutable ledger to reduce fraud risk.

- Cost Efficiency: Minimizing intermediaries while cutting overall transaction costs.

Conclusion and Summary

Tokenization is a transformative technology that blends the physical with the digital, opening up unprecedented opportunities for liquidity, democratized investment, and enhanced market transparency. By converting assets such as real estate, fine art, commodities, and intellectual property into digital tokens, blockchain paves the way for fractional ownership and innovative funding models.

In our exploration, we discussed tokenization’s background, core mechanisms powered by blockchain, and detailed various asset classes that benefit from the technology. We looked at its clear advantages in increasing liquidity, reducing costs, and enhancing trust through secure, immutable transactions. Alongside these advancements, challenges such as regulatory uncertainties, cybersecurity risks, and evolving market adoption persist, underscoring the need for coordinated innovation and standardization.

Looking to the future, the tokenization trend is set to integrate further with both traditional finance and open-source funding models. Enhanced regulatory frameworks, improved smart contract technology, and seamless interoperability between blockchain solutions will foster a hybrid financial ecosystem that benefits investors, developers, and end users alike.

In summary, tokenization of assets represents a pioneering shift in how we interact with both physical and digital value. It stands at the intersection of innovation and finance—transforming ownership, democratizing access, and paving the way for a more inclusive digital economy.

For those interested in diving deeper into this subject, you may explore additional resources such as what is tokenization of assets and further reading on asset tokenization at CoinDesk and FinTech Magazine.

By integrating the lessons from blockchain technology and the open-source community, tokenization is not only reshaping finance but also empowering developers and investors worldwide. As these trends continue to evolve, tokenization will undoubtedly play a pivotal role in building the digital financial systems of tomorrow.

Stay tuned for more insights into blockchain innovations, and consider engaging with the latest developer discussions and funding models in our connected digital era.