Is now a good time to buy bitcoin?

In the face of tariffs and economic uncertainty, is bitcoin a safe haven asset? Plus, gold vs. bitcoin, and Canada launches the world’s first Solana ETFs. The post Is now a good time to buy bitcoin? appeared first on MoneySense.

Welcome to the Canadian Crypto Observer. Financial journalist and author Aditya Nain offers perspective on market-moving headlines to help Canadian investors navigate the cryptocurrency market.

Canadians (and the rest of the world) are living through the economic shock of a tariff war with the United States. Amidst the uncertainty, investors are seeking safe-haven assets. Is bitcoin (BTC) one of these?

Like gold, bitcoin is sometimes touted as a good asset to hold for a rainy day because its fundamentals are not controlled by any one country, company or other organization. The line of thinking is: because BTC is a global asset that isn’t created or controlled by one entity, it may be a good place to park your money during economic upheaval. That, however, doesn’t account for the volatility of crypto’s prices—for example, when BTC fell from about $84,500 to $74,000 (figures in U.S. dollars) between April 2 and 9, 2025.

While BTC may be a good alternative asset, don’t be in a hurry to sell all your stocks, bonds, gold or dollars in exchange for BTC!

Throughout its relatively short life, BTC has behaved a lot like stocks—that is, a high-risk growth asset—than a safe-haven asset. This means BTC drops dramatically during economic shocks and rises dramatically with good news and higher liquidity.

Here’s how BTC performed around the recent “Liberation Day” sell-off in March and April 2025, in comparison to some other major asset classes.

Sell-off around “Liberation Day”

| Bitcoin (IBIT) | Gold (GLD) | S&P 500 (SPY) | U.S. 10-year Treasury bills | |

|---|---|---|---|---|

| March high (USD) | $51.44 | $288.14 | $583.77 | 4.38% |

| April low (USD) | $43.59 | $273.71 | $494.48 | 4.01% |

| Percentage drop | 15.26% | 5% | 15.29% | 8.44% |

3 takeaways from the Liberation Day sell-off

- Neither BTC nor gold are safe-haven assets when judged in the short term. While both may beat inflation over the long term, investors do not sell stocks to buy gold or bitcoin. Rather, they go to U.S. Treasury bonds. The table above shows that bond yields fell in the immediate aftermath of Liberation Day, which means that investors bought bonds. (There’s more recent data to show that U.S. bonds and the U.S. dollar are being sold off, but that started a few days later, when global investors began offloading U.S. investments in response to the tariff war.)

- The S&P 500 fell as much as BTC, from their March highs to April lows of this year. Ordinarily, you’d expect BTC to fall a lot more than the S&P 500 during a sell-off. This tells me that BTC’s risk-return profile has drastically changed because of growing institutional adoption and mainstreaming over the past couple of years. (More on this below.)

- The fact that the S&P 500 fell as much as BTC is also a cautionary tale for investors on the top-heavy nature of the S&P 500 index. Just before the sell-off, the Magnificent 7—the seven largest companies in the index—accounted for a whopping 32% of the index. Is this a cue to diversify your equity portfolio into bitcoin or gold?

The best crypto platforms and apps

We’ve ranked the best crypto exchanges in Canada.

Bitcoin or gold: Which is the better diversifier?

With the S&P 500 falling as much as BTC in 2025, gold on a tear and BTC behaving like a relatively mature asset, Canadian investors may wonder how returns on BTC and gold compare.

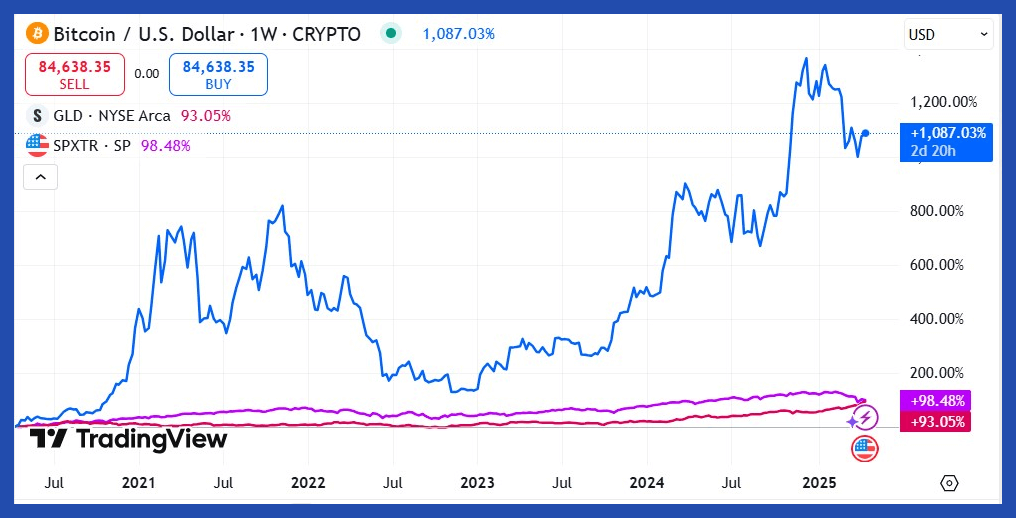

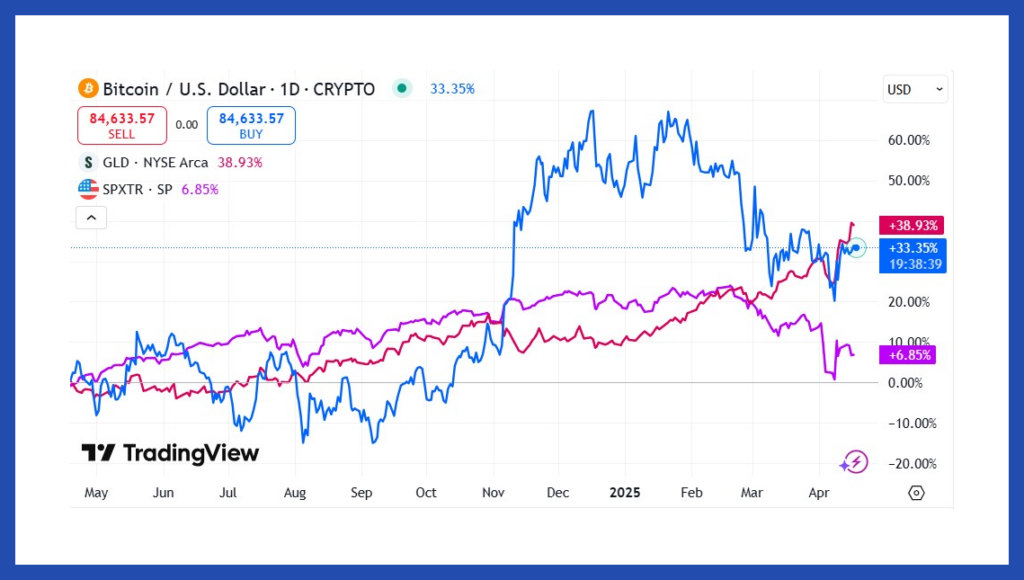

Here’s some data on how these assets have performed—from a pure returns perspective—over two different periods: five years and one year. There’s a stark difference between these periods.

Return terms BTC Gold (GLD) S&P 500 total return 5-year return 1,087% 93.05% 98.43% 1-year return 33.42% 38.93% 6.85%

Source: These figures are from the tables below, created on tradingview.com.

You’ll notice that in the five-year period, gold and the S&P 500 were neck-and-neck, and BTC zoomed ahead. In contrast, over the past year, gold and bitcoin were neck-and-neck leaders, while the S&P 500 lagged behind. Below are two charts representing this data for both periods.

5-year historical returns of BTC, gold (GLD) and the S&P 500

1-year historical returns of BTC, gold (GLD) and S&P 500

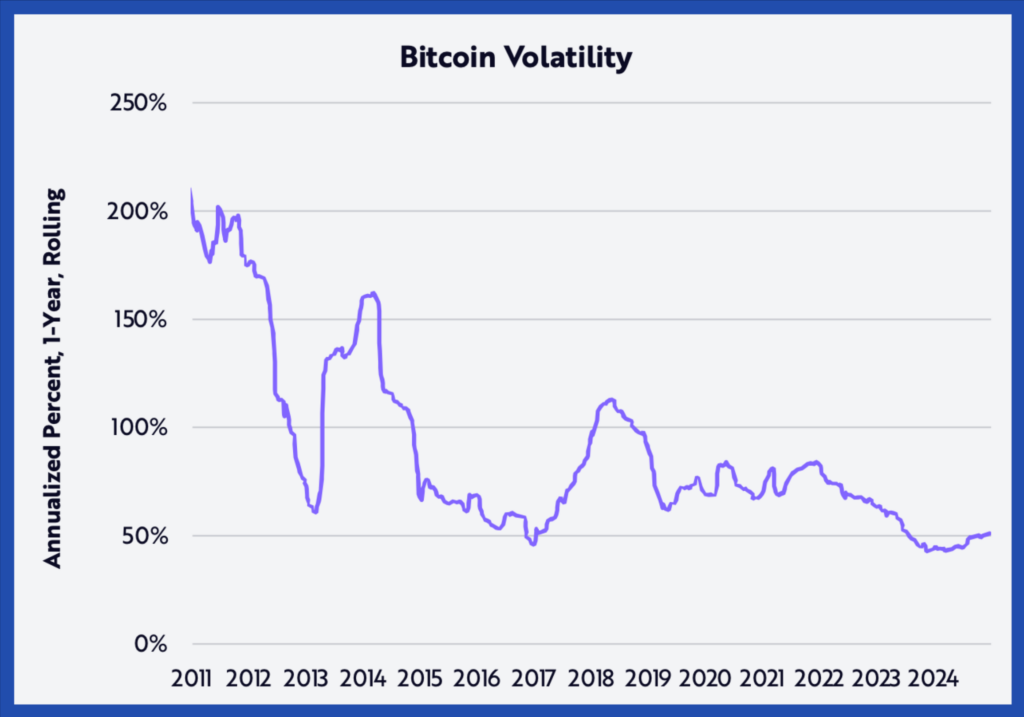

My key takeaway from this data: Gold and BTC are both good diversifiers. In years past, investors preferred diversifying with gold rather than BTC primarily because of the wild swings in the crypto market. However, BTC’s volatility is decreasing as institutional adoption grows. According to research by Ark Invest, BTC’s realized volatility has been declining since 2011, and it now stands at an all-time low, with lower tops through the years. Here’s what that looks like.

The bottom line for me: BTC may be increasingly be used as a portfolio diversifier along with or instead of gold for these reasons:

- BTC’s strong returns

- Decreasing volatility

- Ease of investing through crypto ETFs

- ETFs are eligible for registered accounts such as the TFSA, RRSP, RESP and FHSA

Canada’s (and the world’s) first Solana ETFs

Canada continues to innovate and lead in crypto with the launch of the world’s first Solana (SOL) spot ETFs. Not just one, but four Solana ETFs launched on April 16, 2025. This makes SOL only the second altcoin (after ethereum) to be available through an ETF. An altcoin—short for “alternative coin”—refers to all the crypto coins apart from BTC.

Canada is readying spot Solana ETFs to launch this week after regulator gave green light to multiple issuers incl Purpose, Evolve, CI and 3iQ. ETFs will include staking via TD pic.twitter.com/FSw149Xkm4— Eric Balchunas (@EricBalchunas) April 14, 2025

Solana (SOL) is a fast, high-performance, low-fee blockchain widely considered Ethereum’s top competitor. Developers build Web3 projects on the Solana blockchain. Real-world applications that run on Solana include non-fungible tokens (NFTs), brand loyalty programs and the tokenization of real estate assets. The (in)famous $TRUMP crypto token was built on the Solana blockchain.

The Solana blockchain was launched in March 2020 and is the world’s sixth-largest cryptocurrency by market capitalization. As of April 28, 2025, Solana’s market cap stands at about USD$75.7 billion.

So far, two of the new ETFs (SOLL and SOLQ) offer investors staking rewards, too. Staking is a way to earn yield on your cryptocurrency to boost your returns. If SOL rises in the long term, investors could benefit in two ways: the capital gain from the price of the underlying SOL coins and the staking rewards earned by the fund and passed on to investors.

Here’s what you need to know about the new SOL spot ETFs in Canada:

Purpose

Solana ETFEvolve

Solana ETFCI Galaxy

Solana ETF3iQ Solana

Staking ETFTicker SOLL SOLA SOLX SOLQ Management fee 0.39% 0% until Dec. 31, 2025, then 1% 0% until Jul. 16, 2025, then 0.35% 0% for the first 12 months, then 0.15% Assets under management (AUM) USD$8.6 million USD$6.56 million USD$5.4 million USD$86.6 million Eligible for registered accounts Yes Yes Yes Yes

View a list of crypto spot ETFs in Canada.

MoneySense’s ETF Screener Tool

Resources on crypto taxation in Canada

We’re in the final few days of tax season, and let’s face it, many of us file last-minute. Here are a couple of resources to help with your crypto taxes:

- What you need to know about crypto taxes in Canada

- A simple breakdown of how to calculate crypto capital gains tax in Canada

As always, invest in crypto only if it aligns with your risk tolerance

Cryptocurrencies are speculative, volatile assets subject to significant price swings. Investing in bitcoin and other crypto coins carries market, technological and regulatory risks. Invest in crypto only if it aligns with your investment goals, time horizon and risk profile, and stay vigilant about crypto scams.

Get free MoneySense financial tips, news & advice in your inbox.

More about crypto:

- Will bitcoin crash in 2025?

- Bitcoin tops USD$100,000 for the first time

- Price of bitcoin hits new high after Trump victory, and more crypto news

- How to protect your crypto from hacks

The post Is now a good time to buy bitcoin? appeared first on MoneySense.