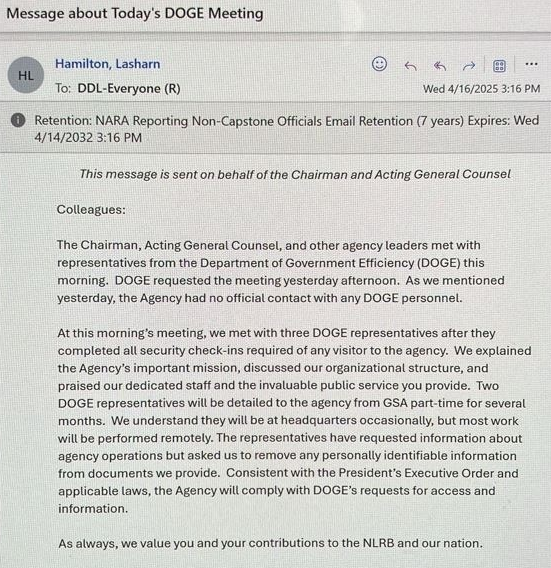

Streaming and Live Music May Escape the Brunt of Trump’s Tariffs. But One Industry Sector Is Getting Hit Hard.

Labels, live businesses and streaming companies’ stocks are mostly living up to music’s reputation as a sturdy investment option in down times. Radio is another story.

Investors seeking shelter from the chaos unleashed by President Trump’s often incoherent tariff policy can find safety in companies without direct exposure to tariffs or the teetering advertising market. And music, especially digital music, will be able to weather the storm, say many analysts — with one major exception.

To understand what people are thinking about tariffs’ impact on the business world, look no further than stock prices. The performance of various music-related stocks reveals how investors are betting that economic uncertainty will affect various companies.

Many stocks — especially those of companies traded on U.S. exchanges — have taken a hit as investors fled for safer alternatives. The Nasdaq and S&P 500, U.S. indexes, are down 6.2% and 6.7%, respectively, since April 1, the day before President Trump announced his tariff plans. Elsewhere in the world, indexes have generally performed better. South Korea’s KOSPI is down just 2.0%. Japan’s Nikkei 225 is off 3.5%. The U.K.’s FTSE 100 is down 4.2%. Germany’s DAX has lost 5.9%.

Within music, companies that get most of their revenue from streaming are faring relatively well. Since April 1, Spotify and Deezer have each gained 4.0%, two of the better showings for music stocks. Cloud Music improved 3.9%. Tencent Music Entertainment, on the other hand, has fallen 15.1%, although its share price remains up 8.1% year to date.

Record labels and publishers have also been holding up well, in relative terms, particularly outside the U.S. Since April 1, shares of Universal Music Group (UMG) — which is headquartered in the U.S. but trades in Amsterdam — and Warner Music Group (WMG) are down 8.0% and 7.1%, respectively. Reservoir Media lost 3.0%. K-pop companies — much like South Korean companies in general — have fared well. Since April 1, SM Entertainment has gained 7.9%, YG Entertainment is up 1.1% and JYP Entertainment has gained 0.7%. HYBE fell 3.4%.

UMG and WMG’s post-tariff declines are slightly greater than the drops in the Nasdaq and S&P 500 of 6.7% and 6.2%, respectively. But both UMG and WMG had strong starts to 2025, and their year-to-date losses of 4.5% and 6.1% are far better than the S&P 500’s 10.2% drop and the Nasdaq’s 15.7% year-to-date decline.

Some live music companies’ stocks have been resilient, too. Live Nation shares are down 3.7% since April 1, while German concert promoter CTS Eventim is up 3.2%. Sphere Entertainment Co., owner of the Sphere venue in Las Vegas, is an exception. Sphere Entertainment shares have plummeted 23.1% since President Trump’s tariff announcement, a far more significant drop than the stocks of other companies — Caesars Entertainment, Wynn Resorts, MGM Resorts — that rely on consumers’ willingness to part with their money in Las Vegas.

For many U.S. media stocks, the direct impact of tariffs is “relatively muted,” wrote Citi analysts in an April 7 report, as many of the companies rely on discretionary spending, not ad revenue. Apple and other tech companies, for example, got an exemption from the 145% tariffs on Chinese imports but must still pay the blanket 20% tariff. Companies that get much of their revenues from subscriptions — Netflix, Spotify, UMG and WMG — will be less impacted.

Music streaming, most notably subscription services, is considered by equity analysts to be safe from whatever tariff-induced economic chaos awaits the global market. “Digital goods are unaffected by tariffs,” wrote TD Cowen analysts in an April 14 investor report. Subscription services, they argued, provide enough bang for the buck, and customers have such an emotional attachment to music that subscribers are unlikely to leave in “meaningful” numbers if the economy goes south.

Streaming and subscription growth slowed in 2024, but many analysts expect improvements to come from a regular drumbeat of price increases, renewed licensing deals and super-premium tiers. That said, analysts believe that Spotify’s latest licensing deals with UMG and WMG, and upcoming deals with other rights holders, better reward labels and publishers for price increases. As a result, TD Cowen slightly lowered its estimates for Spotify’s revenue, gross profit margin and operating income in 2025. Likewise, in an April 4 note to investors, Guggenheim analysts lowered their estimate for Spotify’s gross margin in the second half of 2025.

Companies reliant on advertising revenue will also take an indirect hit. Citi estimates that $4 trillion of imports could generate $700 billion in tariffs and reduce personal consumer and ad spending by 1.9%. Tariffs have ripple effects, too. Because household net worth and personal spending are highly correlated, says Citi, the recent declines in stock prices could reduce personal and advertising spending by 3.0%.

Consumer spending is at the heart of the concert business, but analysts agree that fans’ affection for their favorite artists protects live music from economic downturns. As a result, Live Nation has “less risk than the average business that depends on discretionary spending,” according to TD Cowen analysts.

Advertising-related businesses aren’t so lucky, though. As tariffs raise prices and household wealth declines, personal spending also declines, and, in turn, brands pull back on their advertising spending. Investors’ expectations for advertising-dependent businesses were apparent before April but have become clearer since President Trump’s April 2 tariff announcement. iHeartMedia, which closed on Thursday (April 17) below $1.00 per share for the first time since June 4, 2024, has dropped 35.3% since April 1 and fallen 50.3% year to date. Cumulus Media has fared even worse, dropping 47.5% since April 1 and 62.7% year to date. Townsquare Media has fallen 12.8% in the tariff era and 23.8% year to date.

J.P. Morgan analysts believe iHeartMedia’s full-year guidance of $770 million is “somewhat optimistic” given economic uncertainties and ongoing pressures in the radio business. It forecasts full-year EBITDA of $725 million — nearly 6% lower than iHeartMedia’s guidance. If things wind up going more the way J.P. Morgan predicts than iHeart, it would be a big blow to the company and an unfortunate bellwether for the already struggling radio business. While other music industry sectors look to ride out the tariffs at least in the shorter term, the economic uncertainty introduced by the Trump administration may only hasten radio’s ongoing decline.

As Billboard has noted numerous times in recent weeks, investors are attracted to music assets because they are counter-cyclical, meaning they don’t follow the typical ups and downs of the economy. Consumers will, by and large, stick with their music subscription services and continue going to concerts. But by introducing the tariffs, the Trump regime exposed one of radio’s greatest weaknesses as a business: a greater exposure, due to its reliance on advertising, to the state of the wider economy.