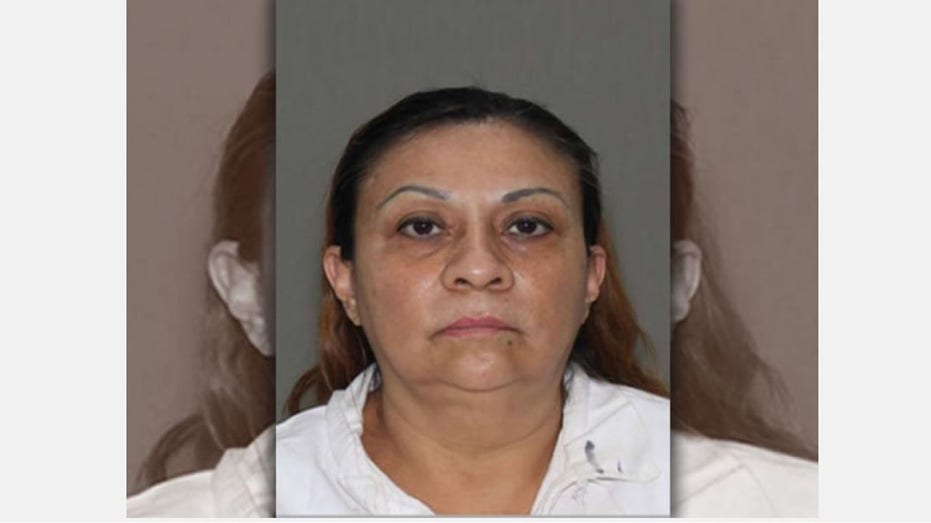

Sean Wilson, financial advisor

This is Sean Wilson, a Certified Financial Planner based in Calgary, Alberta. The post Sean Wilson, financial advisor appeared first on MoneySense.

Meet Sean Wilson

Sean Wilson is a Certified Financial Planner and founder of Moraine Wealth Advisory, a boutique financial planning firm specializing in helping Canadian physicians and business owners achieve their financial and life goals. With many years of experience in financial services, he is dedicated to guiding clients through the complexities of wealth management, tax planning, retirement strategies, and managing accumulated wealth in corporations. He is a registered associate portfolio manager in Alberta, British Columbia and Quebec.

Wilson’s unique expertise lies in understanding the specific challenges faced by medical professionals and business owners. His comprehensive approach focuses on reducing debt, growing wealth, minimizing taxes and designing financial plans that are fully aligned with his client’s personal and professional aspirations.

Passionate about building lasting relationships, he believes financial planning should go beyond numbers. He takes pride in delivering tailored strategies that empower clients to make confident decisions for their future. The advice is clear, actionable, and results-driven, whether it’s optimizing cash flow, balancing salary versus dividend income, or maximizing investments like registered retirement savings plans (RRSPs) and tax-free savings accounts (TFSAs).

Wilson is also committed to financial education. He aims to simplify complex financial planning topics to help clients and prospects understand the value of comprehensive planning. His approachable style has made him a trusted advisor for those seeking clarity and peace of mind in managing their finances.

Services • Financial Planning

• Investment Planning & Implementation

• Fee-only planning Specializations • Comprehensive Financial Planning

• Insurance Planning

• Discretionary Portfolio ManagementPayment Model • Fees paid by clients based on assets managed by advisor

• Fees paid by clients for advice (not based on assets)

• Commissions Languages written and spoken • English

Why did you become a planner?

I became a financial planner because I’m passionate about helping others gain clarity and confidence in their financial lives. Much like coaching sports, it’s rewarding to guide individuals as they navigate decisions and build confidence in their abilities. Seeing the stress and uncertainty that financial challenges can bring, I was inspired to create solutions that empower individuals and families to take control of their futures and achieve their goals.

What is your approach to financial planning?

At Moraine Wealth, our financial planning approach centers on your goals and values, ensuring every strategy aligns with what matters most to people. We prioritize transparency, offering clear advice and fee structures so you can make informed decisions with confidence.

What is your proudest achievement as a financial planner?

When I do pro-bono work for individuals, who have been given horrible advice from someone else, often they are almost in tears when I see them. It feels excellent to help people who desperately need it. You can hear the relief in their voices.

What is a client success story you can share?

I was able to save the prospective client nearly $500,000 in taxes by identifying a major issue with their estate planning on an initial discovery call.

What would you do if money were no object?

I would travel the world to learn how to cook from the best chefs. I love cooking, so that would be one of the ideal things to do.

What is the worst money advice you ever received?

Just borrow more money from the bank.