Linear Regression in Time Series: Sources of Spurious Regression

Why does the autocorrelation of the errors term matter? The post Linear Regression in Time Series: Sources of Spurious Regression appeared first on Towards Data Science.

1. Introduction

It’s pretty clear that most of our work will be automated by AI in the future. This will be possible because many researchers and professionals are working hard to make their work available online. These contributions not only help us understand fundamental concepts but also refine AI models, ultimately freeing up time to focus on other activities.

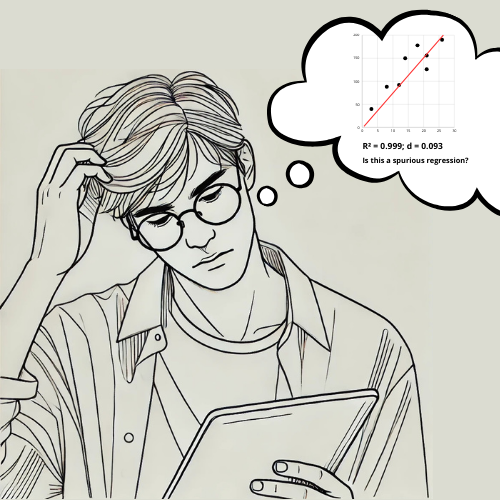

However, there is one concept that remains misunderstood, even among experts. It is spurious regression in time series analysis. This issue arises when regression models suggest strong relationships between variables, even when none exist. It is typically observed in time series regression equations that seem to have a high degree of fit — as indicated by a high R² (coefficient of multiple correlation) — but with an extremely low Durbin-Watson statistic (d), signaling strong autocorrelation in the error terms.

What is particularly surprising is that almost all econometric textbooks warn about the danger of autocorrelated errors, yet this issue persists in many published papers. Granger and Newbold (1974) identified several examples. For instance, they found published equations with R² = 0.997 and the Durbin-Watson statistic (d) equal to 0.53. The most extreme found is an equation with R² = 0.999 and d = 0.093.

It is especially problematic in economics and finance, where many key variables exhibit autocorrelation or serial correlation between adjacent values, particularly if the sampling interval is small, such as a week or a month, leading to misleading conclusions if not handled correctly. For example, today’s GDP is strongly correlated with the GDP of the previous quarter. Our post provides a detailed explanation of the results from Granger and Newbold (1974) and Python simulation (see section 7) replicating the key results presented in their article.

Whether you’re an economist, data scientist, or analyst working with time series data, understanding this issue is crucial to ensuring your models produce meaningful results.

To walk you through this paper, the next section will introduce the random walk and the ARIMA(0,1,1) process. In section 3, we will explain how Granger and Newbold (1974) describe the emergence of nonsense regressions, with examples illustrated in section 4. Finally, we’ll show how to avoid spurious regressions when working with time series data.

2. Simple presentation of a Random Walk and ARIMA(0,1,1) Process

2.1 Random Walk

Let

![Compassionate solutions for food allergies in air travel [PODCAST]](https://kevinmd.com/wp-content/uploads/The-Podcast-by-KevinMD-WideScreen-3000-px-2-scaled.jpg)