AIA: Architecture Billings "Billings remain soft to start the new year"

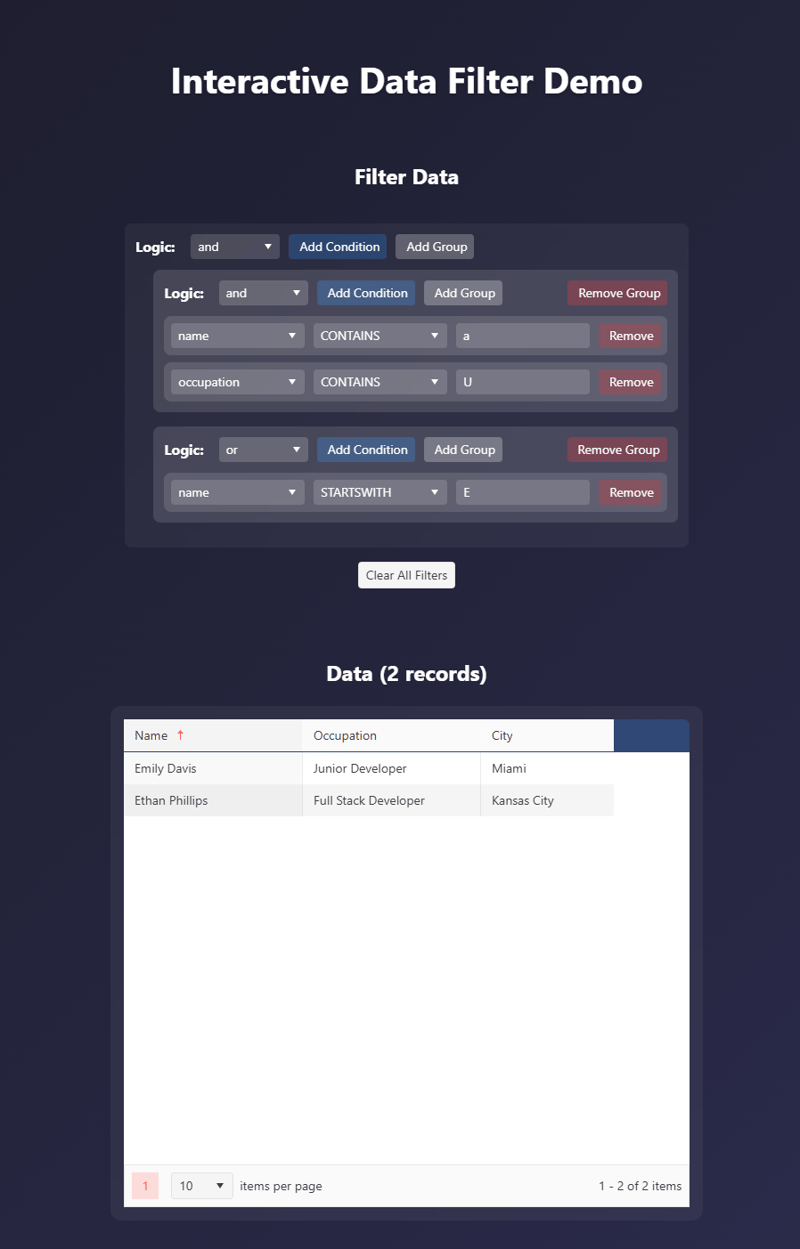

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment. From the AIA: ABI January 2025: Architecture firm billings remain soft to start the new yearThe AIA/Deltek Architecture Billings Index (ABI) score was 45.6 for the month, slightly above the December score. This means that while a majority of firms still saw their billings decrease in January, the share of firms experiencing that decrease was slightly smaller than in December. Inquiries into new projects continued to grow at the same slow pace as in recent months, but the value of newly signed design contracts declined for the eleventh consecutive month as clients remained cautious about committing to new projects during the ongoing economic uncertainty. (Note that every January, the seasonal adjustment factors for all ABI data series are revised, leading to revisions in recent historical data.) Billings were also soft at firms in all regions of the country in January. Firms located in the West saw very modest billings growth in the fourth quarter of 2024, but unfortunately, billings returned to negative territory to start the new year. Business conditions remained softest at firms located in the Northeast, which has been the trend in recent months. And billings softened further at firms located in the South, which saw more encouraging signs last fall, before weakening again. Billings also declined at firms of all specializations in January. Firms with a commercial/industrial specialization continued to be most likely to report softening business conditions, but billings have weakened at firms of all specializations in recent months. ... The ABI score is a leading economic indicator of construction activity, providing an approximately nine-to-twelve-month glimpse into the future of nonresidential construction spending activity. The score is derived from a monthly survey of architecture firms that measures the change in the number of services provided to clients. emphasis added• Northeast (41.1); Midwest (45.6); South (46.0); West (48.8) • Sector index breakdown: commercial/industrial (43.1); institutional (47.4); multifamily residential (45.0) Click on graph for larger image. This graph shows the Architecture Billings Index since 1996. The index was at 45.6 in January, up from 44.1 in December. Anything below 50 indicates a decrease in demand for architects' services.This index has indicated contraction for 26 of the last 28 months. Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions. This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment in 2025.Multi-family billings remained negative has been negative for the last 30 months. This suggests we will see further weakness in multi-family starts.

From the AIA: ABI January 2025: Architecture firm billings remain soft to start the new year

The AIA/Deltek Architecture Billings Index (ABI) score was 45.6 for the month, slightly above the December score. This means that while a majority of firms still saw their billings decrease in January, the share of firms experiencing that decrease was slightly smaller than in December. Inquiries into new projects continued to grow at the same slow pace as in recent months, but the value of newly signed design contracts declined for the eleventh consecutive month as clients remained cautious about committing to new projects during the ongoing economic uncertainty. (Note that every January, the seasonal adjustment factors for all ABI data series are revised, leading to revisions in recent historical data.)• Northeast (41.1); Midwest (45.6); South (46.0); West (48.8)

Billings were also soft at firms in all regions of the country in January. Firms located in the West saw very modest billings growth in the fourth quarter of 2024, but unfortunately, billings returned to negative territory to start the new year. Business conditions remained softest at firms located in the Northeast, which has been the trend in recent months. And billings softened further at firms located in the South, which saw more encouraging signs last fall, before weakening again. Billings also declined at firms of all specializations in January. Firms with a commercial/industrial specialization continued to be most likely to report softening business conditions, but billings have weakened at firms of all specializations in recent months.

...

The ABI score is a leading economic indicator of construction activity, providing an approximately nine-to-twelve-month glimpse into the future of nonresidential construction spending activity. The score is derived from a monthly survey of architecture firms that measures the change in the number of services provided to clients.

emphasis added

• Sector index breakdown: commercial/industrial (43.1); institutional (47.4); multifamily residential (45.0)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 45.6 in January, up from 44.1 in December. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment in 2025.

_JIRAROJ_PRADITCHAROENKUL_Alamy.jpg?#)

_Tanapong_Sungkaew_Alamy.jpg?#)

![‘Yellowjackets’ Stars on Filming [SPOILER]’s ‘Heartbreaking’ Death in Episode 6 and Why It Needed to Happen That Way](https://variety.com/wp-content/uploads/2025/03/Yellowjackts_306_CB_0809_1106_RT.jpg?#)