AAR: Rail Carloads Down YoY in February, Intermodal Up

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission. Uncertainty shapes economic cycles — fueling booms, triggering busts, and driving debates about what comes next. Uncertainty abounds in the railroad industry too, where evolving demand, market conditions, and economic policies constantly create both challenges and opportunities. ... For now, both rail traffic and the broader economy reflect a mix of strengths and weaknesses, with some sectors proving resilient while others struggle in the face of shifting conditions. emphasis added Click on graph for larger image. This graph from the Rail Time Indicators report shows the year-over-year change for carloads, carloads ex-coal, and intermodal. In February, intermodal performance was again strong, with volumes rising 6.4% (66,340 units) year over-year. Originations averaged 276,654 units per week, the most ever for a February. This strength reflects solid consumer spending and, in part, efforts by some importers to expedite shipments in anticipation of tariffs. ... U.S. railroads originated 843,618 carloads in February, down 4.5% from last year. Carloads rose fractionally in January, their first increase in five months. In February, severe floods in the Northeast and frigid temperatures in the upper Midwest and much of the rest of the country constrained rail operations and the ability of rail customers to load and unload freight. Without these weather issues, rail volumes likely would have been higher.

Uncertainty shapes economic cycles — fueling booms, triggering busts, and driving debates about what comes next. Uncertainty abounds in the railroad industry too, where evolving demand, market conditions, and economic policies constantly create both challenges and opportunities.

...

For now, both rail traffic and the broader economy reflect a mix of strengths and weaknesses, with some sectors proving resilient while others struggle in the face of shifting conditions.

emphasis added

Click on graph for larger image.

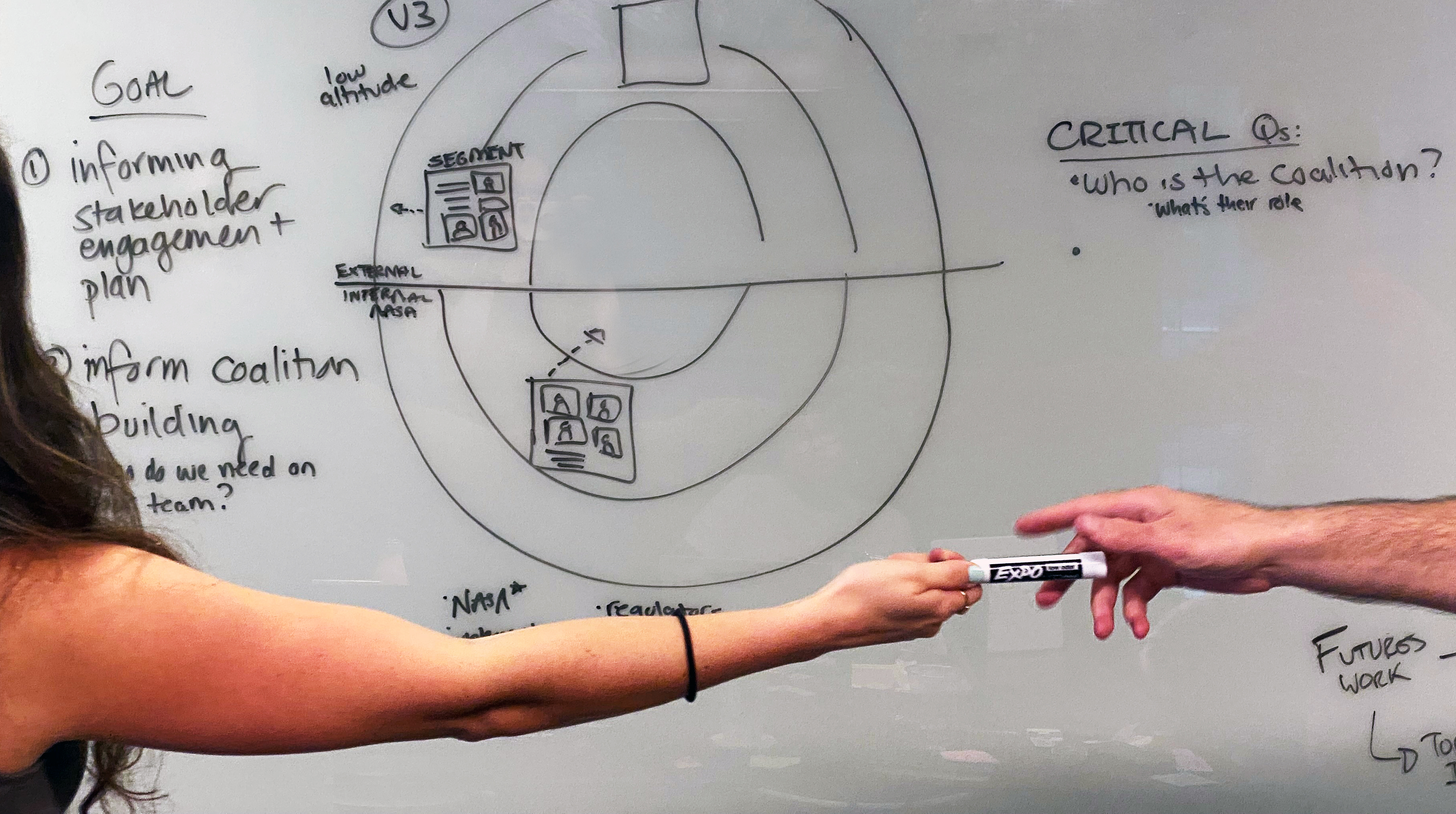

Click on graph for larger image.This graph from the Rail Time Indicators report shows the year-over-year change for carloads, carloads ex-coal, and intermodal.

In February, intermodal performance was again strong, with volumes rising 6.4% (66,340 units) year over-year. Originations averaged 276,654 units per week, the most ever for a February. This strength reflects solid consumer spending and, in part, efforts by some importers to expedite shipments in anticipation of tariffs.

...

U.S. railroads originated 843,618 carloads in February, down 4.5% from last year. Carloads rose fractionally in January, their first increase in five months. In February, severe floods in the Northeast and frigid temperatures in the upper Midwest and much of the rest of the country constrained rail operations and the ability of rail customers to load and unload freight. Without these weather issues, rail volumes likely would have been higher.